How to Tell the Difference Between Small Talk and Identity Theft

Some questions feel warm and harmless at first. Someone asks about your childhood pet or a teacher you liked, and it sounds like they’re trying to get to know you. Most of the time, that’s all it is. But sometimes those same questions serve another purpose. Scammers often wrap data collection in friendly or flirty conversation. The details they ask for are not random. They often match the security questions banks and websites use to confirm your identity. That shift can turn a normal chat into something risky.

Romance scams rely on trust, and casual conversation becomes the entry point. Recognizing which questions deserve caution can help you protect yourself before the situation escalates. Here are a few that are worth pausing over.

What Was Your Mother’s Maiden Name

Credit: Getty Images

This detail is among the most commonly used account recovery questions on banking and financial platforms. It may be framed as an interest in your background or family “roots.” That soft lead-in is often designed to lower your guard before extracting one of the most misused data points in fraud cases.

What Was the Name of Your First Pet

Credit: Getty Images

Nostalgia often softens people, which is why scammers might first share a sweet story about their own dog or cat. Then they’ll ask about yours. Many systems still use this for password recovery. So when someone suddenly asks which childhood pet you adored, they may not just be bonding.

What Street Did You Grow Up On

Credit: Canva

“What part of town did you grow up in?” can sound like an easy way to connect. It feels casual, even nostalgic. But details about your childhood address can also be used to build a profile around you. Banks, lenders, and some customer service systems have used this information as part of identity verification. Even when it’s asked in a friendly way, it’s still personal data worth protecting.

Where Were You Born

Credit: Getty Images

Your place of birth is more than a small biographical detail. Combined with your full name and date of birth, it becomes a powerful verification point. Many institutions use it for identity checks, which also makes it useful to fraudsters who collect pieces of your profile. If someone you barely know pushes for this information early in a conversation, it’s worth slowing down.

What Was the Make of Your First Car

Credit: Getty Images

The make of your first car is often used as an identity verification question by insurers and some financial institutions. Shared casually, it feels harmless. In the wrong hands, it becomes another piece of your personal profile. If someone asks for this detail early in a conversation without a clear reason, treat it as sensitive information.

What High School Did You Attend

Credit: Getty Images

This gets disguised as casual bonding, but the real risk is in how easily it can be cross-referenced with public records or social media. From alumni directories to username patterns, this one offers more access than it seems. Scammers often begin with broad details like this to refine their search.

What’s Your Favorite Teacher’s Name

Credit: Photo Images

Naming a teacher you admired might not seem like a big deal. But this can serve as a custom security question or a way to uncover your school records. If someone steers a conversation toward school memories, then lingers on exact names, take a mental step back.

What’s Your Favorite Color

Credit: Canva

A favorite color seems too basic to worry about, and usually, it is. But a series of these light questions can signal a pattern. Some scammers go wide, collecting dozens of harmless answers to narrow down combinations. If the conversation feels like a trivia quiz, press pause.

What Bank Do You Use

Credit: Wikimedia Commons

Knowing which bank you use allows scammers to craft highly convincing phishing messages that look specific and legitimate. The question may be wrapped inside casual conversation about apps or customer service, but the information itself is valuable. Once someone knows your bank, they can tailor emails or texts that appear authentic and increase the chances you’ll respond.

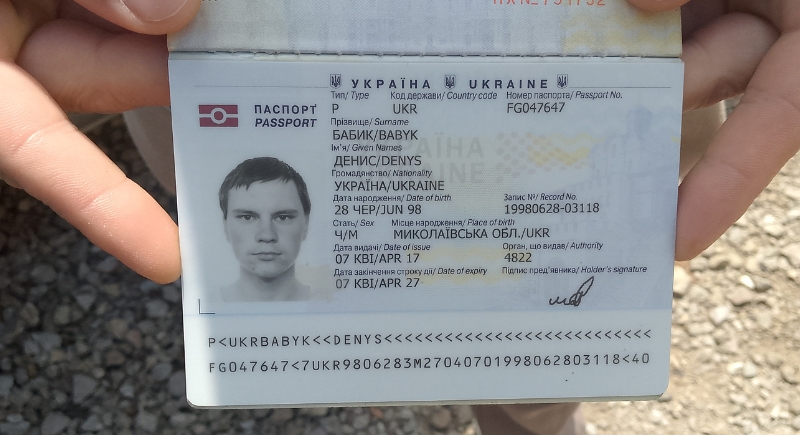

Can I See Your ID

Credit: pixabay

An ID contains your full legal name, address, date of birth, and identification numbers. Those details are exactly what fraudsters need to open accounts or impersonate you. Even a quick photo or brief glance can give someone enough information to misuse later, especially if they have already gathered other pieces of your personal data. Treat any request for your ID with serious caution.