7 Scams That Have Become So Normalized, We Don’t Even Notice Them

We encounter scams so often that they’ve become part of everyday life. From sneaky fees to overpriced services, these little tricks are everywhere, making us part with our hard-earned cash without even realizing it. Some are so subtle that we hardly notice them, while others have become so normalized that we accept them as part of the deal. Check out 7 (and more) of the most common scams that have woven themselves into our daily routines and see if you recognize any of these crafty cons.

Sneaky Hotel Fees

Credit: pexels

Booking a hotel seems straightforward until you check out. Suddenly, there’s a resort fee, a Wi-Fi charge, and even a fee for using the in-room safe. These hidden costs sneak up on you, making a cheap room suddenly expensive. It’s almost like hotels enjoy seeing that look of surprise on your face.

“Free” Trials That Aren’t Free

Credit: pexels

Signing up for a free trial seems harmless. Then, you forget to cancel, and your credit card gets hit with a subscription fee. Companies count on you forgetting, turning “free” into a costly surprise. Keep an eye on your calendar, folks.

Ticket Service Fees

Credit: iStockphoto

Ever bought concert tickets online? The price jumps at checkout due to service fees. These fees can be a substantial percentage of the ticket price. It’s like a concert tax, but where does the money even go?

Shrinking Product Sizes

Credit: Reddit

Have you noticed how your favorite snacks have gotten smaller? Companies reduce product sizes instead of raising prices. It’s a sneaky way to make more money without you noticing right away. Next time, check the weight of the package.

Expensive Printer Ink

Credit: pexels

Printers are cheap, but the ink is pricey. Sometimes, the ink costs more than the printer itself! It’s a clever trick to keep you spending. Maybe it’s time to consider that digital document strategy.

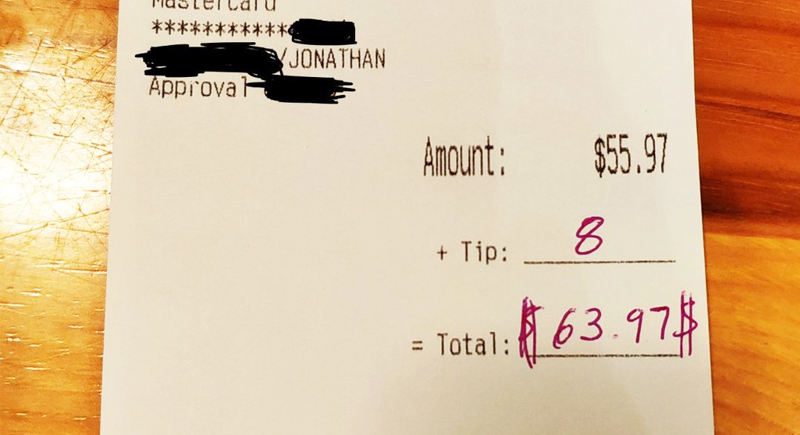

Restaurant Tips on Receipts

Credit: X

Some restaurants automatically include a tip to your bill. If you’re not careful, you might end up tipping twice. It’s a sneaky way for restaurants to boost their staff’s earnings. Always check your receipt before paying.

ATM Fees

Credit: pexels

Using an ATM not affiliated with your bank can cost you. You get hit with a fee from both your bank and the ATM’s bank. These small charges add up quickly. Who knew getting your own money could be so expensive?

Cable and Internet Bundles

Credit: pexels

Bundling services seems like a deal until you see the bill. Hidden fees and increasing rates make that bundle not so attractive. It’s like they lure you in with a good deal and then sneak in the charges. Cutting the cord never looked so good.

Rental Car Insurance

Credit: iStockphoto

When you rent a car, the agent always pushes extra insurance. Often, your personal auto insurance or credit card covers rentals. It’s an upsell that many fall for unnecessarily. Save your money and double-check your coverage.

In-App Purchases

Credit: pexels

Free apps with in-app purchases are designed to hook you. You start playing a game, and soon, you’re buying virtual coins or items. Before you know it, you’ve spent real money on a digital experience. It’s like they’re banking on your addiction.

Credit Card Interest

Credit: pexels

Credit cards offer convenience, but interest rates are sky-high. If you don’t pay your balance in full, those interest charges add up fast. It’s a trap that’s easy to fall into and hard to escape. Pay off your balance to avoid this costly pitfall.

Gym Membership Fees

Credit: pexels

Joining a gym is easy; canceling can be a nightmare. Gyms often have long contracts and hidden cancellation fees. It’s their way of keeping you tied down, even if you stop going. Read the fine print before signing up.

Airline Baggage Fees

Credit: pexels

Flying used to include checked bags, but now it’s an extra cost. Airlines charge for checked and sometimes even carry-on luggage. This fee can significantly increase your travel expenses. Pack light and watch those fees.

Extended Warranties

Credit: pexels

When buying electronics, you’re offered an extended warranty. Often, these warranties are overpriced and rarely used. It’s just another way for retailers to make more money. Consider if you really need that extra protection.

Subscription Services

Credit: pexels

Monthly subscriptions seem cheap but add up over time. Music, movies, and meal kits all take a bite out of your budget. They hope you forget to cancel, so the charges keep rolling in. Maybe it’s time to audit those subscriptions.